Whether you’re thinking about getting your first credit card or just heard someone mention their “credit score,” it’s totally normal to feel a little overwhelmed by the idea of credit. But don’t worry, understanding credit doesn’t have to be complicated.

Let’s break it down in a way that actually makes sense.

💳 What is Credit?

At its core, credit is the ability to borrow money now and pay it back later. Lenders (like banks, credit card companies, or even landlords) want to know if they can trust you to pay them back. That’s where your credit history and credit score come in.

What is a Credit Score?

Your credit score is a 3-digit number (from 300 to 850) that tells lenders how likely you are to repay money you borrow. The higher the score, the better.

General Breakdown:

- Excellent: 800 – 850

- Good: 740 – 799

- Fair: 670 – 739

- Poor: 580 – 669

- Very Poor: below 580

Most people start with no score, and that’s okay! You build credit over time.

5 Things Every Beginner Should Know About Credit

1. Start Small (& Smart)

The easiest way to start building credit is by opening a student credit card, becoming an authorized user on someone else’s card (like a parent’s), or getting a secured credit card (where you put down a deposit).

Tip: Always start with a low limit and use it wisely; this is about building trust, not spending sprees.

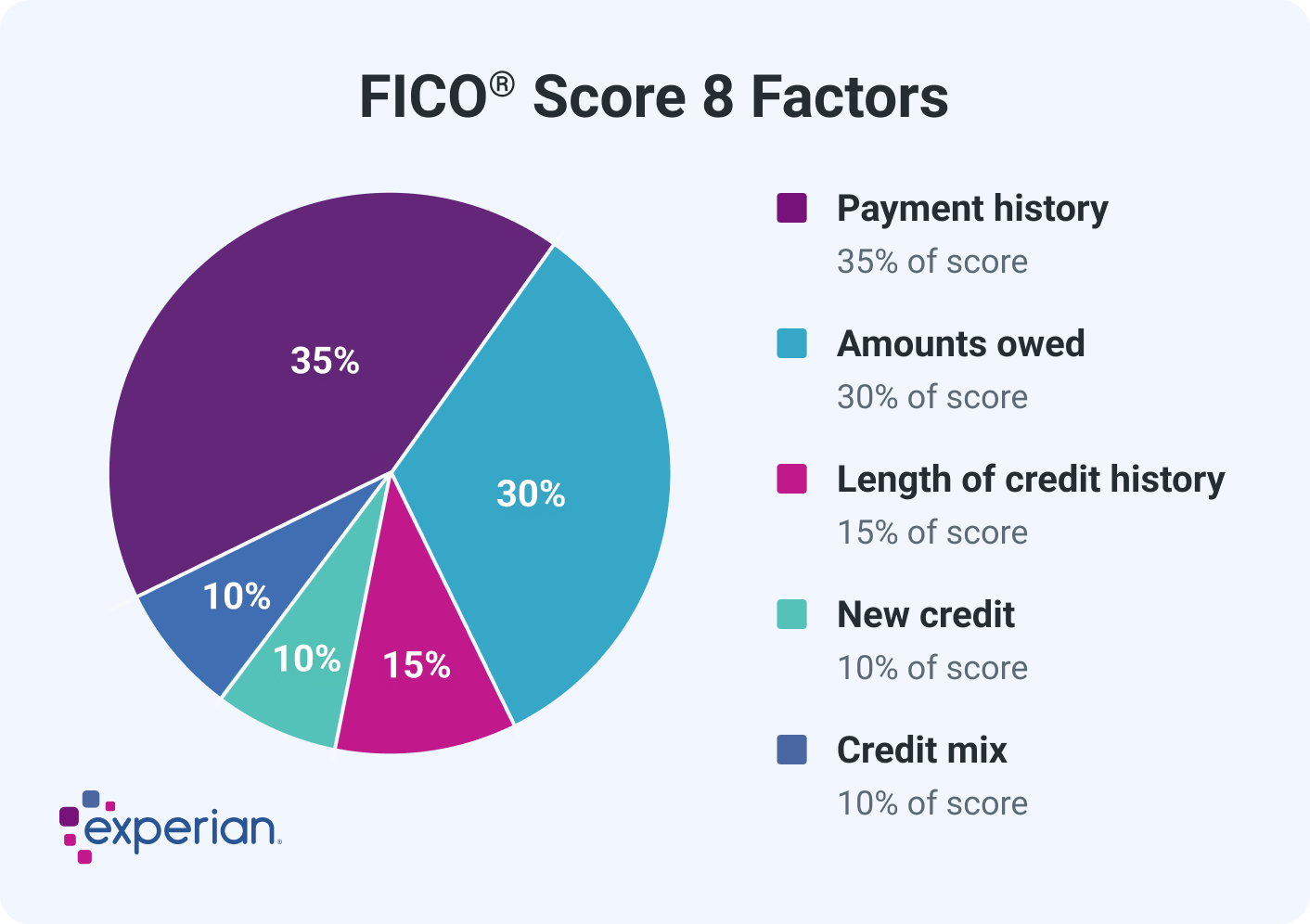

2. Pay On Time. Every SINGLE Time.

Your payment history is the most important part of your credit score, about 35% of it. Even one late payment can hurt. Set reminders, automate payments, whatever it takes just DO NOT miss due dates.

3. Keep Your Credit Use Low

This is called credit utilization, how much of your available credit you’re using. Try to stay below 30% of your limit. So if you have a $500 limit, aim to use less than $150.

Using less shows lenders you’re responsible, not desperate.

4. Don’t Open Too Many Accounts at Once

Each time you apply for credit, it causes a “hard inquiry,” which can slightly lower your score. Opening too many accounts quickly can make you look risky to lenders.

Focus on quality, not quantity. One or two good cards are enough to start.

5. Check Your Credit Regularly

You can check your credit report for free once a year from all three major bureaus (Experian, Equifax, TransUnion) at AnnualCreditReport.com.

There are also free apps like Credit Karma or CreditWise that give you updates and tips.

Why Does Credit Even Matter?

Here’s where credit comes into play:

- Renting an apartment

- Buying a car

- Getting a loan for school or business

- Setting up utilities or a phone plan

- Even job applications in some industries

Basically, building credit is building opportunity.

Final Thoughts

You don’t need to be rich to have good credit; you just need to be intentional. Start small, be consistent, and treat your credit like a plant. Water it (pay your bills), give it sunlight (use it wisely), and be patient.

Did I miss something? Feel free to comment below and don’t forget to like a subscribe to not miss out on any future posts.

See you soon in my next blog post🌟

– Estefany

Leave a comment